14 min read • Healthcare & life sciences

Why patient centricity is key to long-term pharma company success

Patient centricity seems to be an obvious focus for pharmaceutical companies. After all, their core business is to develop drugs and treatments to meet specific patient needs.

Yet, patient centricity is not evident across the end-to-end pharma value chain, from identifying unmet patient needs through drug discovery and development to product availability and treatment. For example, on average, 30% of patients leave clinical trials before their scheduled treatment completion date, often because of the high burden of the trials on their lives.

Poor patient centricity has a direct impact on company success — not listening to the “Voice of the Patient” or failure to communicate with them effectively can cause delays in clinical trial completion. This may then lead to loss of commercial opportunities due to delayed regulatory approval. On the post-approval side, misalignment with patient needs may lead to poor uptake of the medicines and missed financial targets.

True patient centricity is therefore increasingly becoming a key determinant of success for pharmaceutical businesses. Advances in technology such as AI support this, for example, enabling companies to find patients much more efficiently. The real winners will be companies that are prepared to see patients as the cornerstone around whom the entire process is built, from drug discovery to commercialization, and invest the right amounts of money, time, and resources to understand patient needs. In this environment, only companies that truly understand what drives their target patient population and adjust their practices to become more patient centric will stand any chance of success.

With focus on the end-to-end value chain, this article explains how pharma companies can become truly patient centric. Many of the insights can also be applied more broadly across other industries where customer centricity is increasingly critical to success.

The Growing Need to Put the Patient at the Center of Drug Development

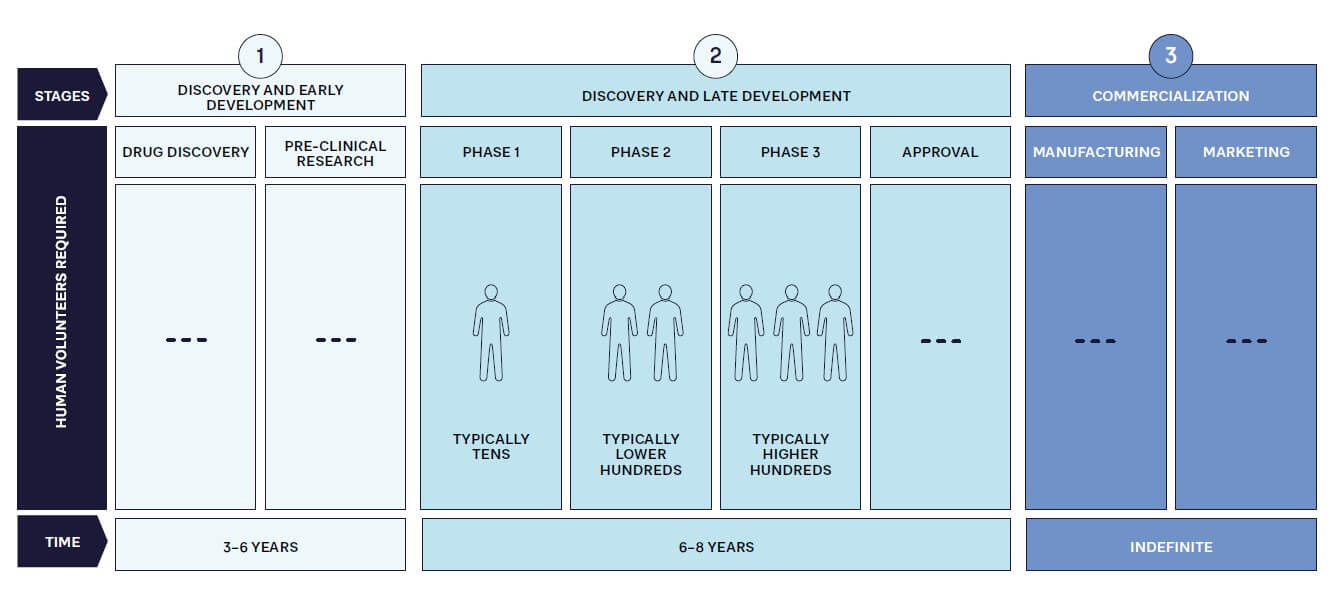

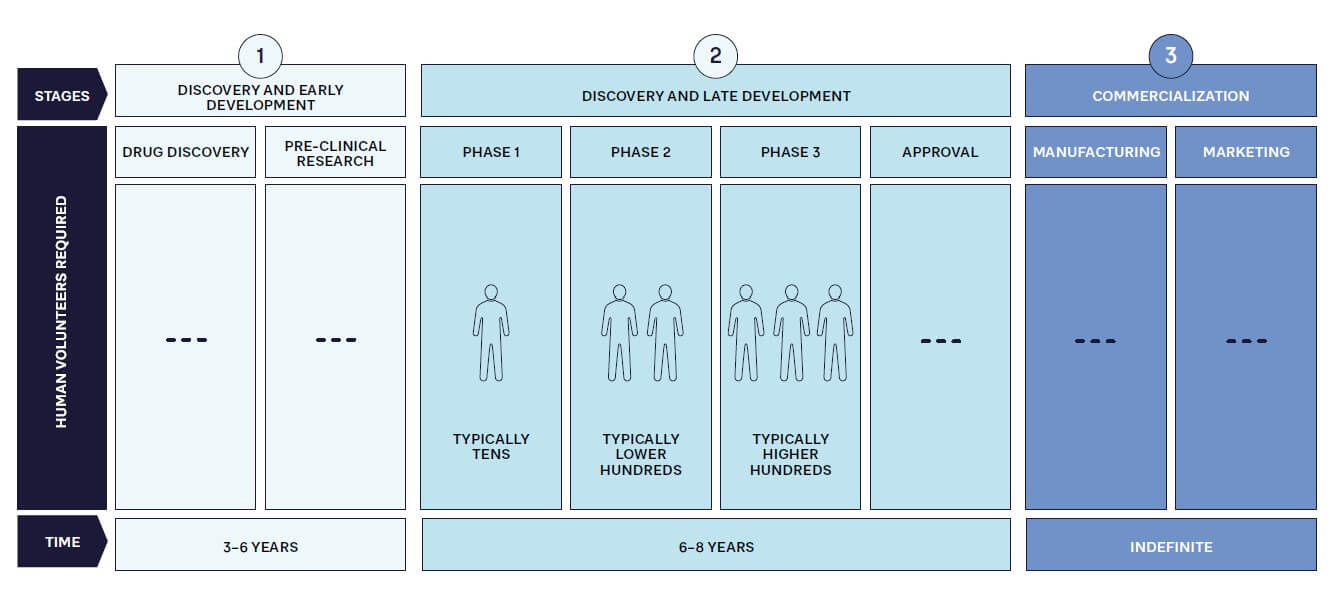

As in other industries, pharmaceutical companies must become more customer centric and compete by providing the products that patients require, when and where they need them. This is increasingly important because patients are becoming more informed and expect treatments to meet their needs. In addition, patient advocacy groups are more active and vocal about considering patients’ needs in the drug development and commercialization process. Patient centricity therefore must be a key factor at every stage of the pharmaceutical value chain to maximize the significant investment (see Figure 1) required for success with an innovative drug.

Clearly, designing and launching a blockbuster drug won’t deliver benefits if supply chain issues mean it is unavailable to potential customers. A current, very clear example of this is Wegovy from Novo Nordisk. Initially intended for diabetes patients, this drug has been found to help weight loss, which has dramatically accelerated its demand. Although the company is working hard to expand capacity, access to Wegovy is now restricted in a number of countries, to the point of restrictions on exports and prescriptions for non-diabetics.

We focus on three key areas of the value chain where patient centricity should be central — understanding unmet needs in discovery and early development, clinical trials in late development, and the post-approval/commercialization phase.

Understanding Unmet Needs in Discovery (Early Development Phase)

The drug development process first focuses on patients when companies identify an unmet need or one that can be met more successfully through new approaches in order to create a target product profile (TPP). While this may appear simple, multiple factors are involved. For example, the need must be commercially viable, whether in terms of the size of the patient population or access to funding for drugs. This calculation has meant developing drugs for common diseases or new antibiotics in poorer, developing countries has been curtailed by lack of a commercial market. However, new approaches, such as funding from governments, charities, and NGOs, potentially change this equation, as shown by the recent introduction of GSK’s RTS,S vaccine against malaria, which is funded by Gavi (whose members include pharmaceutical companies); the Vaccine Alliance; the Global Fund to Fight AIDS, Tuberculosis and Malaria; and Unitaid.

Patient Centricity in Clinical Trials (Late Development Phase)

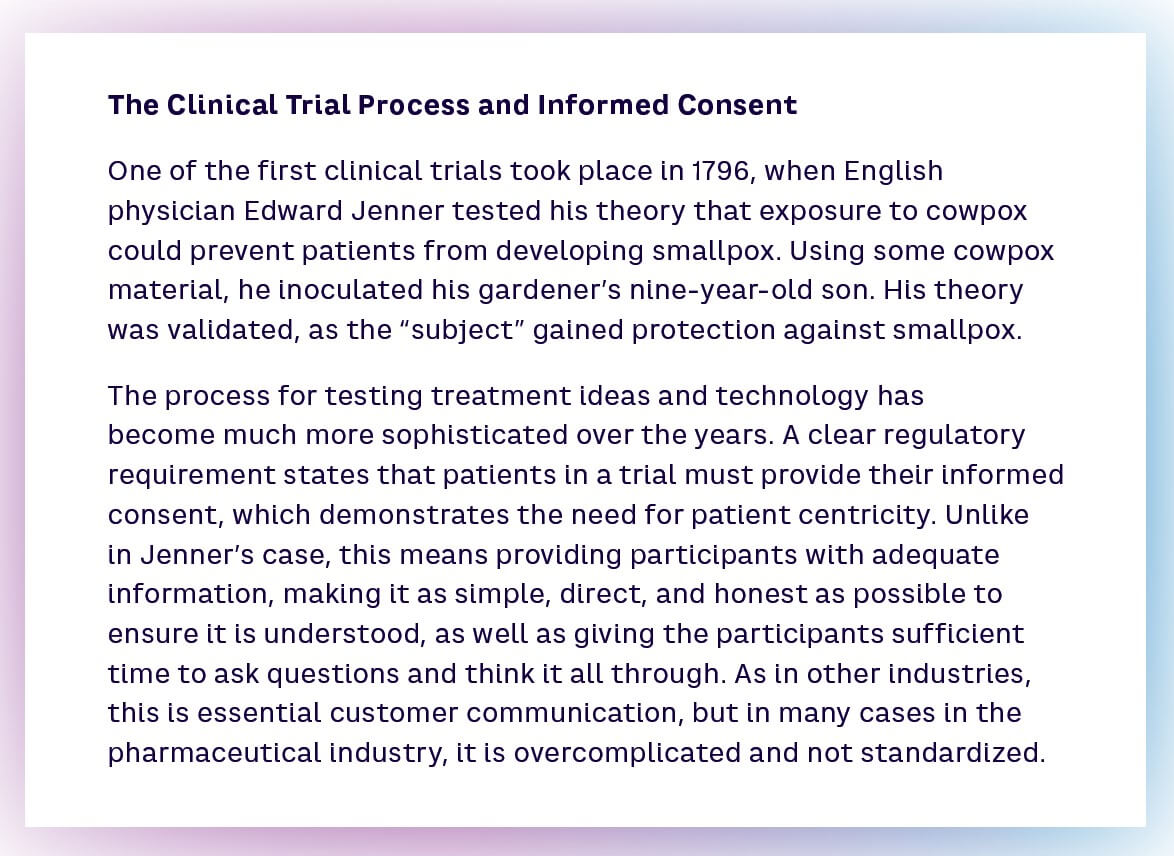

Clinical trials take up a significant share of effort and resources invested in the drug development process. The main factor that distinguishes them from other stages is the direct involvement of consenting humans as subjects. Clinical trials have evolved over time — early drugs were tested with a lot less regulation than is presently in place. In some cases, drugs were tested on prisoners or other people without consent. Events such as the thalidomide scandal led to regulatory changes, which have contributed significantly to the evolution of clinical trials.

Recruiting and enrolling patients in trials has always been a challenge for the pharmaceutical industry. However, it is becoming more difficult for a number of reasons, which is driving a need for greater patient centricity to encourage increased patient involvement:

-

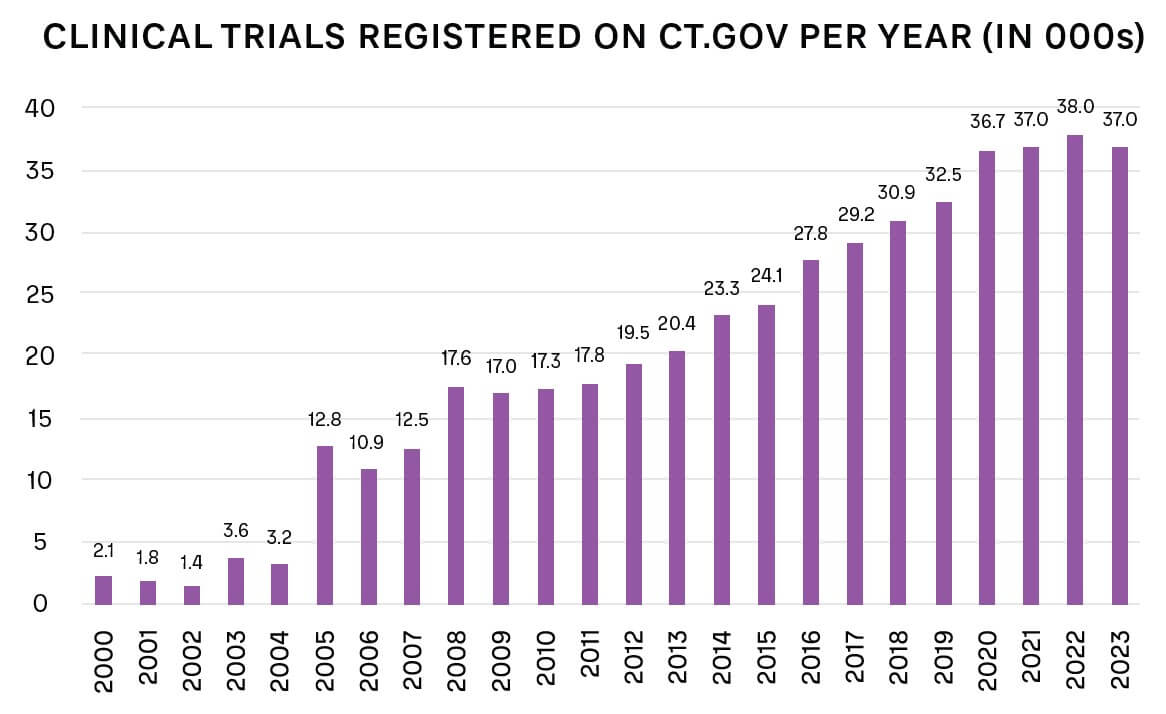

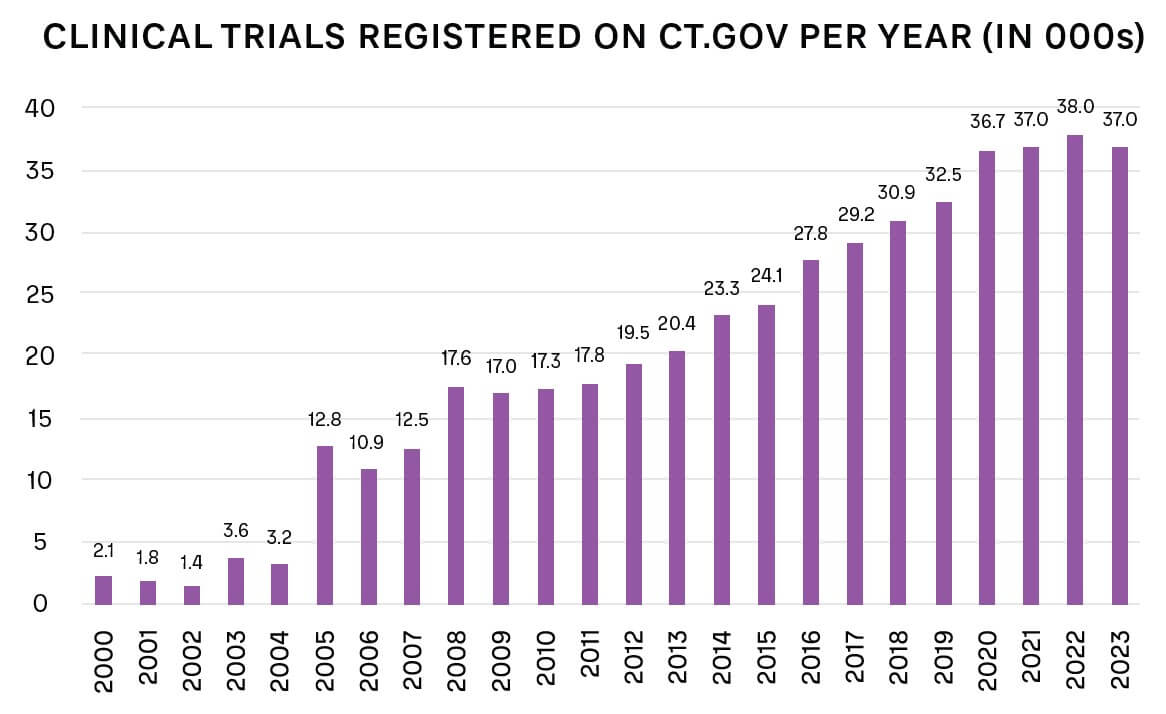

For many conditions, approved, effective drugs are already available, which lowers the incentive for patients to take part in a new trial with unknown benefits. The number of new trials is also increasing overall, as shown in Figure 2.

-

An increasing number of trials are for drugs targeting rarer diseases, with consequently smaller available patient populations.

-

Relevant patients may have particular challenges with taking part in trials because of their location and personal circumstances. For example, if a drug targets a condition prevalent in patients in their 70s with mobility and technology challenges, it needs to use non-digital channels to communicate and ensure that trial sites are easily accessible.

-

Patients may have difficulty finding the right trial for their specific condition, for example, if they suffer from a particular rare type of cancer. However, specialist organizations now exist to match patients to trials. Finding patients for trials and trials for patients has become its own industry, driven by large amounts of data (such as through X [formerly known as Twitter], Facebook, and specialist electronic health record [EHR] companies, with many startups developing their own algorithms to match patients and trials).

Clinical trial retention is also an issue, particularly as patients, like all customers, now have higher expectations for how they will be treated. Patients may drop out of clinical trials for several reasons, such as:

-

They don’t see an impact from the trial, particularly if given a placebo.

-

They suffer from minor and/or major side effects.

-

They move far away from the trial site (which is particularly an issue for centralized trials).

-

They are unable to continue a commitment to longer-term trials because of changing circumstances, such as those where they are tested weekly for many months.

Making trials attractive to patients requires focus on three key areas:

1. Trial Design

Trials need to be built on an understanding of the needs of the patient, rather than solely the requirements of the regulator and trial sponsor. These needs must be considered holistically — not just the patient’s medical condition and how it impacts their life, but also the impact of the trial on their jobs, their family situation, and their care providers.

2. Patient Burden

Given the choice, patients will naturally choose trials in which they have to do as little as possible and will gain as much as possible. Applying this understanding to trial design is therefore vital: minimizing the patient burden and eliminating barriers to participation, such as shortening their length, organizing home visits, or arranging transport to trial sites.

3. Patient Benefit

Patients join trials with the hope that it will improve their condition or treat their disease. Many are therefore disappointed, and may drop out, if they see no impact. Consequently, a growing number of trials are changing the ratio of active drugs to placebos from the traditional 50/50 to 66/33, as this increases the chances of patients seeing an improvement.

Patient Centricity After Approval (Commercialization Phase)

Once a drug is moving toward regulatory approval, pharma companies need to ensure that insurers and public health systems are willing to pay for it, particularly with highly priced drugs. This requires engagement with key opinion leaders (generally leading doctors or academics, or both), insurers, government bodies (such as NICE in the UK), and pharmacy benefit managers to demonstrate the advantages against those of any existing alternatives.

As well as focusing on reimbursement, pharma companies must ensure a sufficient supply to scale to meet market needs — such as by licensing production to third parties, as shown by the rollout of COVID-19 vaccines. Creating demand and then not fulfilling it quickly enough will impact patient relationships and lead them to switch to alternatives, even if technically inferior, or even purchase counterfeit versions of popular drugs via the internet, creating risks to their health, as well as the company’s reputation and revenues. As the Wegovy weight loss example demonstrates, doctors can prescribe drugs for conditions beyond their original target, potentially making planning of production volumes difficult. While the need for sales does mean companies have increased focus on patient centricity, they must also understand that patient expectations are changing and continually improve commercial operations accordingly.

From the patient viewpoint, the ease with which the treatment can be taken is also important. For example, pills, which can be self-administered, are simpler to deal with than infusions or treatments, which require visits to hospitals or clinics. Improving the drug, such as by changing its form or how it needs to be taken, makes treatment easier for patients — while also extending patent lifecycles and thus increasing revenues.

Any ongoing monitoring needs to be straightforward, rather than relying on complex medical devices or lengthy repeat appointments. Pharma companies have learned from other industries — for example, Novartis’ first CAR-T cancer treatment was logistically complex, high cost (around US $500,000 per treatment), and a process taking weeks. To help patient adoption, Novartis adapted techniques from service industries, providing a “white glove” service to patients to walk them through the entire process.

Listening to the Voice of the Patient — Directly and Indirectly

Pharmaceutical companies need to focus on becoming patient centric across everything they do. They should consider how they talk about patients internally and how they engage and communicate with them. In many cases, pharma companies now hold open days on their campuses, bringing patients on site. This not only educates patients themselves on development activities, but more importantly, gives staff direct, real world experience of patients with specific conditions. This aims to embed patient centricity in the working lives and behaviors of staff by connecting them to patients and their needs.

Technology is also a significant tool here, which can be used to learn what patients or their carers are saying or thinking, or to directly interact with them through apps that support the therapy, for example.

In the case of rare diseases, which have smaller patient populations, companies can engage directly with known individuals and nurture relationships. However, in areas where multiple drugs are being developed, competition for patient time can be fierce — only those companies that deliver on their expectations and needs will build viable, long-term relationships.

As well as direct connections with patients, pharma companies need to work closely with patient advocacy groups — organizations created to represent and support patients and their families living with a specific condition. Often, but not always, focused on rare diseases, these groups provide a focal point for interactions with patient communities, as well as a source of potential clinical trial participants. They also may offer support for regulatory approval as regulators increasingly look to patients for their views. Consequently, pharma companies often support, fund, or sponsor patient advocacy groups and their events and initiatives.

Practical Ways to Become More Patient Centric

Radical change is needed to improve the experience of patients across the value chain. Of course, patient centricity can also increase complexity and cost. However, new approaches, often driven by technology, can help make this easier to manage, as well as maximize the resulting benefits. To successfully put the patient at the heart of the drug development and commercialization value chain, pharma companies need to focus on four key areas — putting patients first, incentivizing participation, leveraging technology, and improving communication/care.

1. Put the Patient First

Patients should sit at the center of pharma company thinking, from identifying needs through clinical trial design and delivery to commercialization. The burden on patients should be kept to a minimum, and communication should be tailored and personalized to meet their needs. Data is at the heart of delivering a scalable, patient-first approach. Building online and offline communities, either directly or via patient advocacy groups, nurtures strong relationships and enables pharma companies to communicate and engage patients globally and at scale.

As part of this, companies should look to collect as much data as possible during trials, while remaining patient centric. This should help minimize the need to carry out multiple trials. For example, patient follow-up data can be used more productively by contributing it to a central repository, where a large, anonymized data set is held to build a better picture of a disease across drug companies and healthcare systems.

2. Incentivize Participation and make Prescribing and Purchasing Easier

Patients are not paid to engage with pharmaceutical companies or take part in trials, although clearly they stand to benefit from improved treatments down the line. Yet they provide a critical component of developing an approved drug — without the pharma company identifying their needs and running successful trials, even the most promising drug will not reach the market.

Consequently, while pharma companies covering trial-related expenses for patients has been common practice for many years, they can potentially go further, such as by issuing a trial completion bonus to acknowledge and reward patient commitment. In addition, sponsors can share the proceeds of success with patients if the drug achieves successful regulatory approval. This risk-reward sharing approach will encourage retention of patients and demonstrate a positive patient-centric shift for pharmaceutical companies.

To increase access to drugs, companies are aiming to make buying and prescribing simpler. For example, in the US, new legislation aims to make access to insulin much more affordable for diabetes patients, while pharma companies reimburse commercial patients for out-of-pocket costs (copay). This process involves many more players in the healthcare system than just the pharma company and patients.

3. Leverage Technology

Harnessing technology assists in engaging with patients and lowering their burden, both when trials begin and when drugs are prescribed. For example, by analyzing healthcare data, AI-driven knowledge graphs can identify patients with specific diseases or conditions, even to the level of carrying out predictive analysis to identify those at risk of developing a condition before it has been diagnosed. Such technology-enabled approaches provide significant benefits for most stakeholders involved, from the patient to the clinical trial sponsor, and even the overall healthcare system. As well as identifying potential trial participants, they help find patients once treatments are approved, particularly those suffering from rare conditions.

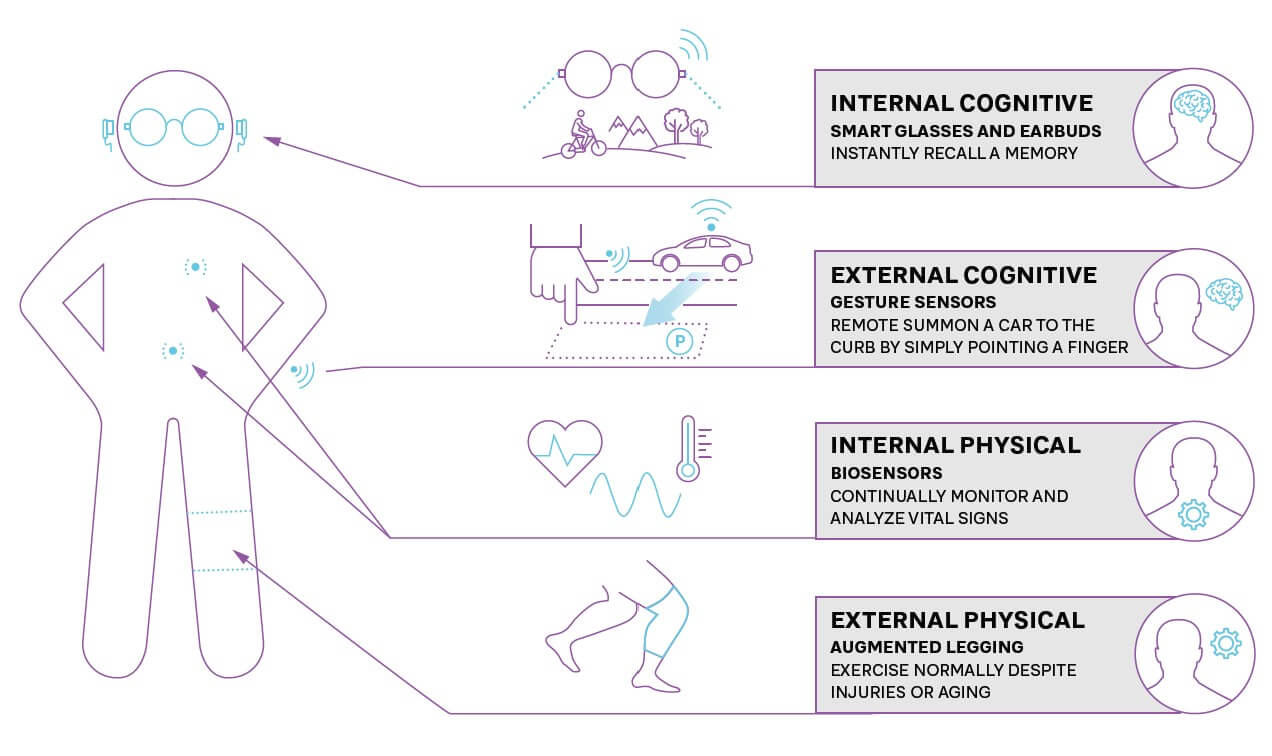

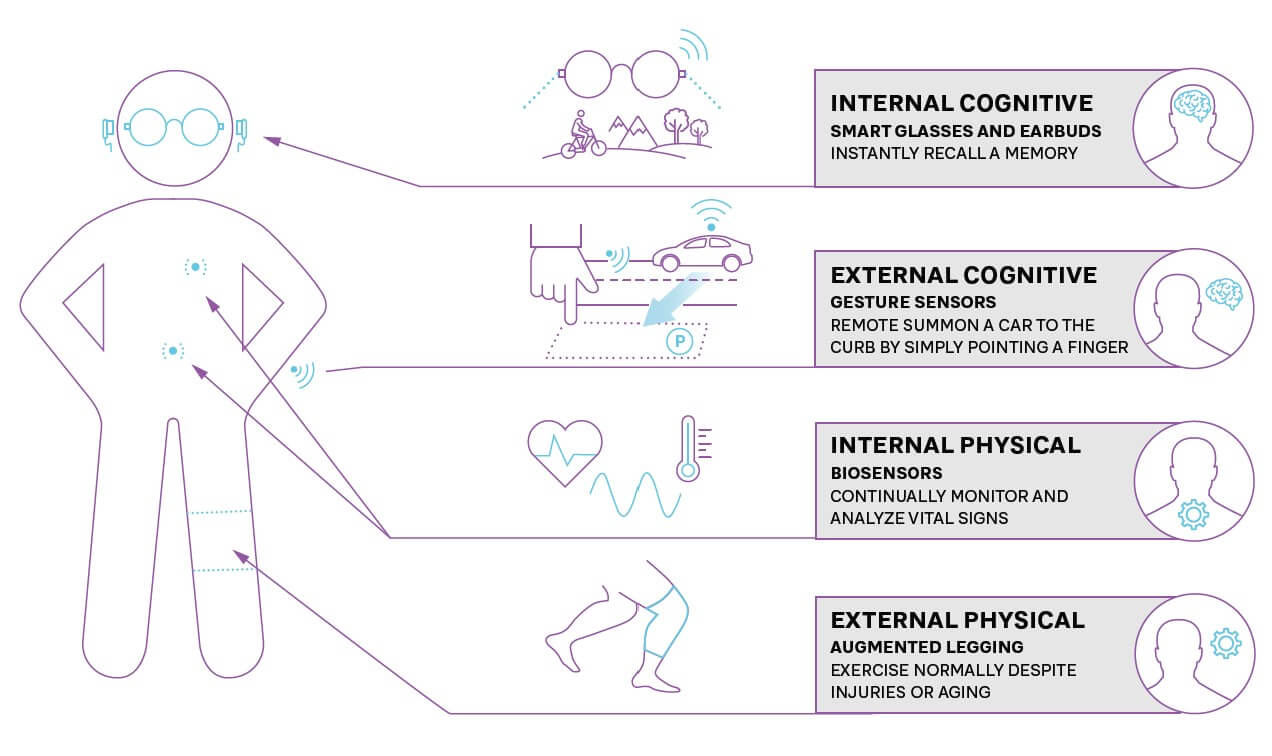

During and even after trials, wearable technology, such as Fitbits and Apple Watches, as well as smaller, less intrusive sensors, can transform monitoring by continually measuring relevant trial end points (see Figure 3). Smart glasses and internal and external biosensors can deliver real-time results via smartphones, lowering the patient burden and need for physical visits to trial sites, while increasing the speed and volume of data available. While many clinical trials are now adopting these mobile technologies, they can still be perceived as “nice to have” or limited to a few therapy areas. In the future, these will become the normal standards across all types of clinical trials.

When drugs are prescribed, sensors and wearable technology can monitor for any potential side effects (such as raised blood pressure) or indicators that show a need for further treatment. Companies can enhance adherence to treatment plans by providing apps with their drug to ensure that doses are taken correctly, monitor effectiveness, and allow patients to share their experiences.

4. Focus on Communication and Care

Pharma companies need to strengthen communication and care for patients, but are traditionally at arm’s length from patients, with many countries prohibiting direct sponsor contact with patients. That means they need to educate, communicate, and train those involved in a patient’s treatment, such as doctors, nurses, and other care givers. This requires creating compelling, effective personalized programs that use a mix of digital and physical channels to explain the benefits of a drug and how it should be prescribed so healthcare professionals can effectively convey the message to patients.

Insights for the Executive

While the pharmaceutical industry is unique in many ways, the need to focus on the customer/patient and design and deliver a tailored, end-to-end service is applicable to businesses well beyond the sector. Patients, like customers, have the power of choice, which is increasingly driving their actions, especially in competitive markets where multiple pharma companies are developing or offering relevant treatments.

To succeed in an increasingly customer-centric world, companies should focus on:

-

Understand the complete impact of using or buying a product or service: How do needs change across the lifecycle, and how can they be delivered holistically? How do you minimize customer/patient effort and maximize their benefit?

-

Listen to patients/customers and trusted third parties, such as patient advocacy groups, charities, and consumer organizations. Involve them early in the design and co-creation of processes to ensure customer centricity.

-

Build a culture focused on the patient/customer: This includes the language used to describe customers, the minimum standards they should expect, and commitment to putting their needs first.

-

Continually collect feedback and use this to drive improvements in processes and operations.

-

Embrace new technology, such as AI and wearables, to improve the experience for patients and customers and remove bottlenecks and burdens for them.

-

Incentivize loyalty, for example, through providing bonuses for clinical trial participants or identifying and rewarding key customers.

Focusing on the customer is a priority for every industry. Patient centricity best practices therefore have a broader application across different sectors, helping increase engagement, loyalty, and revenues.

14 min read • Healthcare & life sciences

Why patient centricity is key to long-term pharma company success

DATE

Patient centricity seems to be an obvious focus for pharmaceutical companies. After all, their core business is to develop drugs and treatments to meet specific patient needs.

Yet, patient centricity is not evident across the end-to-end pharma value chain, from identifying unmet patient needs through drug discovery and development to product availability and treatment. For example, on average, 30% of patients leave clinical trials before their scheduled treatment completion date, often because of the high burden of the trials on their lives.

Poor patient centricity has a direct impact on company success — not listening to the “Voice of the Patient” or failure to communicate with them effectively can cause delays in clinical trial completion. This may then lead to loss of commercial opportunities due to delayed regulatory approval. On the post-approval side, misalignment with patient needs may lead to poor uptake of the medicines and missed financial targets.

True patient centricity is therefore increasingly becoming a key determinant of success for pharmaceutical businesses. Advances in technology such as AI support this, for example, enabling companies to find patients much more efficiently. The real winners will be companies that are prepared to see patients as the cornerstone around whom the entire process is built, from drug discovery to commercialization, and invest the right amounts of money, time, and resources to understand patient needs. In this environment, only companies that truly understand what drives their target patient population and adjust their practices to become more patient centric will stand any chance of success.

With focus on the end-to-end value chain, this article explains how pharma companies can become truly patient centric. Many of the insights can also be applied more broadly across other industries where customer centricity is increasingly critical to success.

The Growing Need to Put the Patient at the Center of Drug Development

As in other industries, pharmaceutical companies must become more customer centric and compete by providing the products that patients require, when and where they need them. This is increasingly important because patients are becoming more informed and expect treatments to meet their needs. In addition, patient advocacy groups are more active and vocal about considering patients’ needs in the drug development and commercialization process. Patient centricity therefore must be a key factor at every stage of the pharmaceutical value chain to maximize the significant investment (see Figure 1) required for success with an innovative drug.

Clearly, designing and launching a blockbuster drug won’t deliver benefits if supply chain issues mean it is unavailable to potential customers. A current, very clear example of this is Wegovy from Novo Nordisk. Initially intended for diabetes patients, this drug has been found to help weight loss, which has dramatically accelerated its demand. Although the company is working hard to expand capacity, access to Wegovy is now restricted in a number of countries, to the point of restrictions on exports and prescriptions for non-diabetics.

We focus on three key areas of the value chain where patient centricity should be central — understanding unmet needs in discovery and early development, clinical trials in late development, and the post-approval/commercialization phase.

Understanding Unmet Needs in Discovery (Early Development Phase)

The drug development process first focuses on patients when companies identify an unmet need or one that can be met more successfully through new approaches in order to create a target product profile (TPP). While this may appear simple, multiple factors are involved. For example, the need must be commercially viable, whether in terms of the size of the patient population or access to funding for drugs. This calculation has meant developing drugs for common diseases or new antibiotics in poorer, developing countries has been curtailed by lack of a commercial market. However, new approaches, such as funding from governments, charities, and NGOs, potentially change this equation, as shown by the recent introduction of GSK’s RTS,S vaccine against malaria, which is funded by Gavi (whose members include pharmaceutical companies); the Vaccine Alliance; the Global Fund to Fight AIDS, Tuberculosis and Malaria; and Unitaid.

Patient Centricity in Clinical Trials (Late Development Phase)

Clinical trials take up a significant share of effort and resources invested in the drug development process. The main factor that distinguishes them from other stages is the direct involvement of consenting humans as subjects. Clinical trials have evolved over time — early drugs were tested with a lot less regulation than is presently in place. In some cases, drugs were tested on prisoners or other people without consent. Events such as the thalidomide scandal led to regulatory changes, which have contributed significantly to the evolution of clinical trials.

Recruiting and enrolling patients in trials has always been a challenge for the pharmaceutical industry. However, it is becoming more difficult for a number of reasons, which is driving a need for greater patient centricity to encourage increased patient involvement:

-

For many conditions, approved, effective drugs are already available, which lowers the incentive for patients to take part in a new trial with unknown benefits. The number of new trials is also increasing overall, as shown in Figure 2.

-

An increasing number of trials are for drugs targeting rarer diseases, with consequently smaller available patient populations.

-

Relevant patients may have particular challenges with taking part in trials because of their location and personal circumstances. For example, if a drug targets a condition prevalent in patients in their 70s with mobility and technology challenges, it needs to use non-digital channels to communicate and ensure that trial sites are easily accessible.

-

Patients may have difficulty finding the right trial for their specific condition, for example, if they suffer from a particular rare type of cancer. However, specialist organizations now exist to match patients to trials. Finding patients for trials and trials for patients has become its own industry, driven by large amounts of data (such as through X [formerly known as Twitter], Facebook, and specialist electronic health record [EHR] companies, with many startups developing their own algorithms to match patients and trials).

Clinical trial retention is also an issue, particularly as patients, like all customers, now have higher expectations for how they will be treated. Patients may drop out of clinical trials for several reasons, such as:

-

They don’t see an impact from the trial, particularly if given a placebo.

-

They suffer from minor and/or major side effects.

-

They move far away from the trial site (which is particularly an issue for centralized trials).

-

They are unable to continue a commitment to longer-term trials because of changing circumstances, such as those where they are tested weekly for many months.

Making trials attractive to patients requires focus on three key areas:

1. Trial Design

Trials need to be built on an understanding of the needs of the patient, rather than solely the requirements of the regulator and trial sponsor. These needs must be considered holistically — not just the patient’s medical condition and how it impacts their life, but also the impact of the trial on their jobs, their family situation, and their care providers.

2. Patient Burden

Given the choice, patients will naturally choose trials in which they have to do as little as possible and will gain as much as possible. Applying this understanding to trial design is therefore vital: minimizing the patient burden and eliminating barriers to participation, such as shortening their length, organizing home visits, or arranging transport to trial sites.

3. Patient Benefit

Patients join trials with the hope that it will improve their condition or treat their disease. Many are therefore disappointed, and may drop out, if they see no impact. Consequently, a growing number of trials are changing the ratio of active drugs to placebos from the traditional 50/50 to 66/33, as this increases the chances of patients seeing an improvement.

Patient Centricity After Approval (Commercialization Phase)

Once a drug is moving toward regulatory approval, pharma companies need to ensure that insurers and public health systems are willing to pay for it, particularly with highly priced drugs. This requires engagement with key opinion leaders (generally leading doctors or academics, or both), insurers, government bodies (such as NICE in the UK), and pharmacy benefit managers to demonstrate the advantages against those of any existing alternatives.

As well as focusing on reimbursement, pharma companies must ensure a sufficient supply to scale to meet market needs — such as by licensing production to third parties, as shown by the rollout of COVID-19 vaccines. Creating demand and then not fulfilling it quickly enough will impact patient relationships and lead them to switch to alternatives, even if technically inferior, or even purchase counterfeit versions of popular drugs via the internet, creating risks to their health, as well as the company’s reputation and revenues. As the Wegovy weight loss example demonstrates, doctors can prescribe drugs for conditions beyond their original target, potentially making planning of production volumes difficult. While the need for sales does mean companies have increased focus on patient centricity, they must also understand that patient expectations are changing and continually improve commercial operations accordingly.

From the patient viewpoint, the ease with which the treatment can be taken is also important. For example, pills, which can be self-administered, are simpler to deal with than infusions or treatments, which require visits to hospitals or clinics. Improving the drug, such as by changing its form or how it needs to be taken, makes treatment easier for patients — while also extending patent lifecycles and thus increasing revenues.

Any ongoing monitoring needs to be straightforward, rather than relying on complex medical devices or lengthy repeat appointments. Pharma companies have learned from other industries — for example, Novartis’ first CAR-T cancer treatment was logistically complex, high cost (around US $500,000 per treatment), and a process taking weeks. To help patient adoption, Novartis adapted techniques from service industries, providing a “white glove” service to patients to walk them through the entire process.

Listening to the Voice of the Patient — Directly and Indirectly

Pharmaceutical companies need to focus on becoming patient centric across everything they do. They should consider how they talk about patients internally and how they engage and communicate with them. In many cases, pharma companies now hold open days on their campuses, bringing patients on site. This not only educates patients themselves on development activities, but more importantly, gives staff direct, real world experience of patients with specific conditions. This aims to embed patient centricity in the working lives and behaviors of staff by connecting them to patients and their needs.

Technology is also a significant tool here, which can be used to learn what patients or their carers are saying or thinking, or to directly interact with them through apps that support the therapy, for example.

In the case of rare diseases, which have smaller patient populations, companies can engage directly with known individuals and nurture relationships. However, in areas where multiple drugs are being developed, competition for patient time can be fierce — only those companies that deliver on their expectations and needs will build viable, long-term relationships.

As well as direct connections with patients, pharma companies need to work closely with patient advocacy groups — organizations created to represent and support patients and their families living with a specific condition. Often, but not always, focused on rare diseases, these groups provide a focal point for interactions with patient communities, as well as a source of potential clinical trial participants. They also may offer support for regulatory approval as regulators increasingly look to patients for their views. Consequently, pharma companies often support, fund, or sponsor patient advocacy groups and their events and initiatives.

Practical Ways to Become More Patient Centric

Radical change is needed to improve the experience of patients across the value chain. Of course, patient centricity can also increase complexity and cost. However, new approaches, often driven by technology, can help make this easier to manage, as well as maximize the resulting benefits. To successfully put the patient at the heart of the drug development and commercialization value chain, pharma companies need to focus on four key areas — putting patients first, incentivizing participation, leveraging technology, and improving communication/care.

1. Put the Patient First

Patients should sit at the center of pharma company thinking, from identifying needs through clinical trial design and delivery to commercialization. The burden on patients should be kept to a minimum, and communication should be tailored and personalized to meet their needs. Data is at the heart of delivering a scalable, patient-first approach. Building online and offline communities, either directly or via patient advocacy groups, nurtures strong relationships and enables pharma companies to communicate and engage patients globally and at scale.

As part of this, companies should look to collect as much data as possible during trials, while remaining patient centric. This should help minimize the need to carry out multiple trials. For example, patient follow-up data can be used more productively by contributing it to a central repository, where a large, anonymized data set is held to build a better picture of a disease across drug companies and healthcare systems.

2. Incentivize Participation and make Prescribing and Purchasing Easier

Patients are not paid to engage with pharmaceutical companies or take part in trials, although clearly they stand to benefit from improved treatments down the line. Yet they provide a critical component of developing an approved drug — without the pharma company identifying their needs and running successful trials, even the most promising drug will not reach the market.

Consequently, while pharma companies covering trial-related expenses for patients has been common practice for many years, they can potentially go further, such as by issuing a trial completion bonus to acknowledge and reward patient commitment. In addition, sponsors can share the proceeds of success with patients if the drug achieves successful regulatory approval. This risk-reward sharing approach will encourage retention of patients and demonstrate a positive patient-centric shift for pharmaceutical companies.

To increase access to drugs, companies are aiming to make buying and prescribing simpler. For example, in the US, new legislation aims to make access to insulin much more affordable for diabetes patients, while pharma companies reimburse commercial patients for out-of-pocket costs (copay). This process involves many more players in the healthcare system than just the pharma company and patients.

3. Leverage Technology

Harnessing technology assists in engaging with patients and lowering their burden, both when trials begin and when drugs are prescribed. For example, by analyzing healthcare data, AI-driven knowledge graphs can identify patients with specific diseases or conditions, even to the level of carrying out predictive analysis to identify those at risk of developing a condition before it has been diagnosed. Such technology-enabled approaches provide significant benefits for most stakeholders involved, from the patient to the clinical trial sponsor, and even the overall healthcare system. As well as identifying potential trial participants, they help find patients once treatments are approved, particularly those suffering from rare conditions.

During and even after trials, wearable technology, such as Fitbits and Apple Watches, as well as smaller, less intrusive sensors, can transform monitoring by continually measuring relevant trial end points (see Figure 3). Smart glasses and internal and external biosensors can deliver real-time results via smartphones, lowering the patient burden and need for physical visits to trial sites, while increasing the speed and volume of data available. While many clinical trials are now adopting these mobile technologies, they can still be perceived as “nice to have” or limited to a few therapy areas. In the future, these will become the normal standards across all types of clinical trials.

When drugs are prescribed, sensors and wearable technology can monitor for any potential side effects (such as raised blood pressure) or indicators that show a need for further treatment. Companies can enhance adherence to treatment plans by providing apps with their drug to ensure that doses are taken correctly, monitor effectiveness, and allow patients to share their experiences.

4. Focus on Communication and Care

Pharma companies need to strengthen communication and care for patients, but are traditionally at arm’s length from patients, with many countries prohibiting direct sponsor contact with patients. That means they need to educate, communicate, and train those involved in a patient’s treatment, such as doctors, nurses, and other care givers. This requires creating compelling, effective personalized programs that use a mix of digital and physical channels to explain the benefits of a drug and how it should be prescribed so healthcare professionals can effectively convey the message to patients.

Insights for the Executive

While the pharmaceutical industry is unique in many ways, the need to focus on the customer/patient and design and deliver a tailored, end-to-end service is applicable to businesses well beyond the sector. Patients, like customers, have the power of choice, which is increasingly driving their actions, especially in competitive markets where multiple pharma companies are developing or offering relevant treatments.

To succeed in an increasingly customer-centric world, companies should focus on:

-

Understand the complete impact of using or buying a product or service: How do needs change across the lifecycle, and how can they be delivered holistically? How do you minimize customer/patient effort and maximize their benefit?

-

Listen to patients/customers and trusted third parties, such as patient advocacy groups, charities, and consumer organizations. Involve them early in the design and co-creation of processes to ensure customer centricity.

-

Build a culture focused on the patient/customer: This includes the language used to describe customers, the minimum standards they should expect, and commitment to putting their needs first.

-

Continually collect feedback and use this to drive improvements in processes and operations.

-

Embrace new technology, such as AI and wearables, to improve the experience for patients and customers and remove bottlenecks and burdens for them.

-

Incentivize loyalty, for example, through providing bonuses for clinical trial participants or identifying and rewarding key customers.

Focusing on the customer is a priority for every industry. Patient centricity best practices therefore have a broader application across different sectors, helping increase engagement, loyalty, and revenues.