DOWNLOAD

DATE

Contact

Energy consumption by the data center industry accounts for more than 1% of the world’s power consumption and is expected to reach 8% by 2030, according to the International Energy Agency. The EU aims to be climate neutral by 2050, and data centers can contribute significantly to that goal. Iberia, targeted as a strategic cloud region by hyperscalers and other cloud players, has all the key factors for green data center location, providing an attractive market for investors in sustainable power-supply projects.

DATA CENTERS’ ROLE IN DECARBONIZATION

The EU has set an ambitious goal of achieving carbon neutrality by 2050, which includes net-zero greenhouse gas (GHG) emissions. The power sector is responsible for about three-quarters of global GHG emissions, making it the largest contributor to climate change. With power demand set to increase in the coming decades, achieving the EU’s goal will require a transformation of energy production, transportation, and consumption systems.

Governments, companies, and investors will need to work together to achieve the decarbonization of energy systems. For example, renewables are at the heart of the clean energy transition, but they require demand-management solutions, such as updated power grids, heat pumps, and batteries and other energy-storage solutions.

The data center colocation market is a €6 billion industry in Europe (about US $6.6 billion) and is expected to grow at a 7% CAGR in the next four years, driven by demand from hyperscalers and adoption of advanced computing technologies like artificial intelligence, the Internet of Things, and blockchain. Increased support from governments via tax incentives or energy subsidies is also driving the amount of data needing be transferred and stored. Many businesses struggle to efficiently operate in-house data centers in the face of high bandwidth demands and the need for increased data security.

Our analysis shows that the main growth opportunities for data centers are in countries with a low colocation density (the number of colocation sites per 100,000 individuals). For instance, Spain has a colocation density of 0.3x, and Portugal’s colocation density is 0.2x. This represents an excellent opportunity for businesses and investors to tap into these markets and support their growth.

LOWERING DATA CENTER ENERGY DEMAND

Data center energy consumption comes from five main sources: (1) cooling to keep temperatures optimal; (2) server and storage to run computational workloads and store data (e.g., hard disks/tape drives); (3) network hardware (switches, routers, fiber-optic cables, firewalls); (4) power-conversion energy, such as supply systems, transformers, and power distribution units; and (5) lighting.

Data centers consume about 200 terawatts per hour (TWh) per year globally, of which about 90 TWh are directly attributable to the three largest hyperscalers: Amazon, Microsoft, and Google. Data center energy demand is forecasted to increase by about 15x by 2030 to reach 8% of total projected electricity demand. Climate change, shareholder pressure, and sustainability-related regulations are driving providers to search for clean energy alternatives to power their data centers.

Only new colocation builds that incorporate energy-efficiency and overall sustainability practices will ensure robust operations and grid connections. Thus, a set of sustainable design elements and construction practices that preserve energy and limit waste are being incorporated into the industry:

-

Renewable energy sources. Shift to 24/7 carbon-free energy while retaining the ability to match changing energy demands during the day.

-

Backup power and generators. Shift from diesel to hydrogen and lithium batteries, using advanced software to automatically manage surplus when supply exceeds demand.

-

Water usage. Advanced cooling system use non-potable water or waterless cooling. Data centers can also participate in water-replenishment programs.

-

Heat recycling. Reuse “waste” heat to heat buildings, homes, and other facilities in collaboration with a local energy provider.

-

Storage and chip efficiency. Increase efficiency via new types of computers, data storage, and networks.

-

Circular design. Seek out sustainable design and construction strategies aimed at reducing waste associated with land clearing or the manufacturing and transportation of building materials. Consider using recycled materials and electronic waste, including partnering with those in secondary-material markets, retrofitting existing buildings into data centers, and/or using prefabricated modular construction.

-

Business continuity. Control potential sources of data center outages, security issues, and safety concerns (e.g., automation and predictive analytics to mitigate climate and security risks).

THE PROVIDER PERSPECTIVE

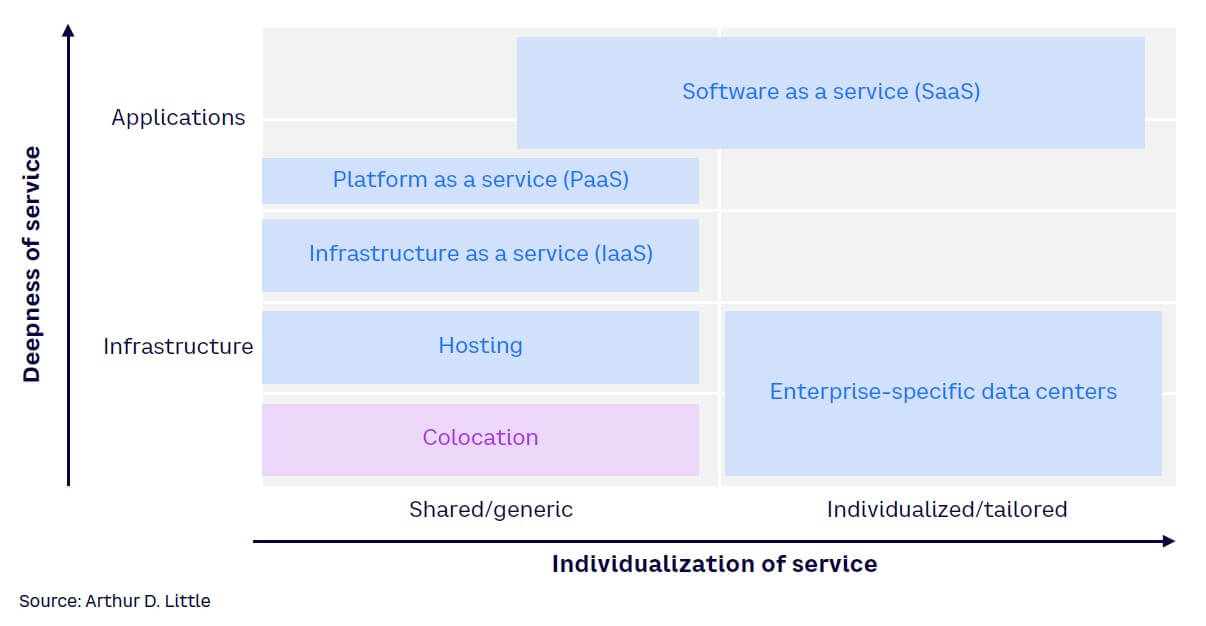

To understand the role green data centers could play, it is important to consider the entire data center ecosystem, including the fact that the services provided by data centers affect their energy constraints (see Figure 1). For example, if a data center only offers colocation services, its energy needs will be lower. This is how carrier hotels like Equinix and Interxion function, mainly renting space in their facilities. The client is responsible for obtaining the energy needed to run its hardware and software, making energy costs a key factor when selecting a facility.

When providers offer additional services, such as hosting or software as a service, the provider is responsible for a larger chunk of the energy costs. Having greater access to renewable energy sources will allow it to price those services more competitively. This has historically been the case for hyperscalers like AWS and Google, but some recent European projects have relied on colocation developers to construct their facilities, sometimes creating joint ventures with engineering companies to ensure the completed facility meets the hyperscaler’s energy standards.

BENEFITS OF GREEN DATA CENTERS

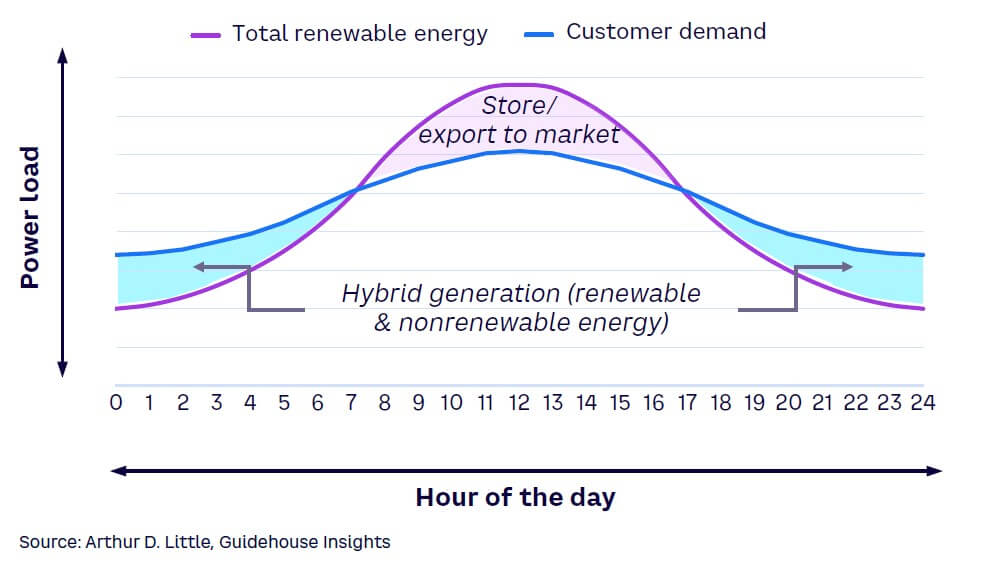

Data centers are integrated with the energy grid and contribute to the needs of the communities in which they operate. Thus, they have the potential to play an active role in stabilizing the electrical grid. Data center energy consumption rises and falls, tending to peak during business hours. Data centers can draw on renewable sources to create a flatter profile (see Figure 2). However, when renewable energy sources are not enough to meet demand, electricity needs should be supplemented with technologies like energy storage, hydro, or biomass/biogas. As noted above, depending on the service delivered by the owner of the data center, this could be an issue for the owner or for the client/tenant. Either way, being able to manage the supply coming from various renewable energy sources is likely to be beneficial for both parties.

The data center industry can contribute to a more stable and cost-efficient energy system and reduce costs. Data centers can make use of renewable sources like solar and wind-power energy to create an energy-supply profile that better fits customer demand:

-

During peak-demand periods when nonrenewable sources are pricier, green energy can kick in.

-

Surplus electricity generated from renewable sources can be stored or channeled back to the grid.

-

Dispatchable technologies (e.g., batteries) can help data centers manage renewable energy supplies.

Given the world’s escalating power demands and new challenges posed by extreme weather events, connecting data centers to solar and/or wind farms could be a game-changing strategy. Last summer, the UK experienced the power grid’s vulnerability resulting from soaring temperatures. Several hospitals faced IT disruptions when Oracle had to shut down two data centers due to the heat. At about the same time across the Atlantic, Dominion Energy, one of the largest utilities in the US, said it was having trouble meeting the demand from the data center cluster in Virginia.

The shift to renewable energy sources not only curtails environmental impact, it also ensures a reliable power supply when faced with grid disruptions from climate change and other factors. This approach lets data centers tap into a constant, clean supply of energy, bolstered by cutting-edge energy-storage solutions. For example, batteries can capture surplus energy during periods of low demand and release it during peak hours or grid outages to ensure uninterrupted operations.

GEOGRAPHIC CONSIDERATIONS

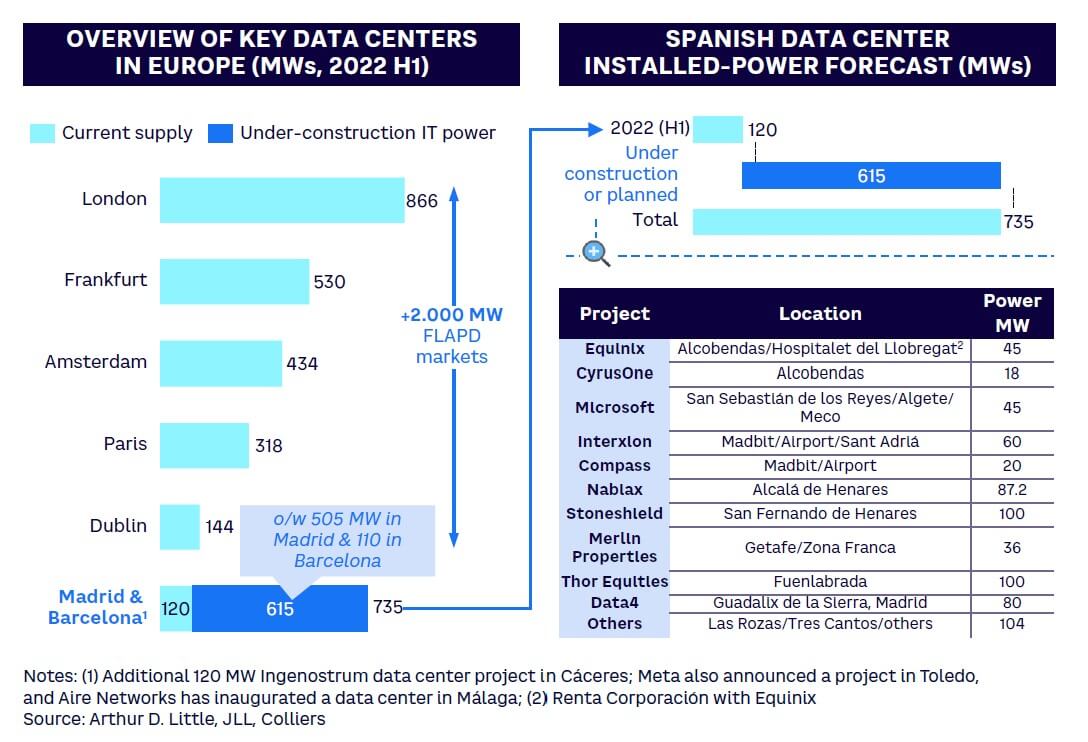

To succeed with this approach, data centers must seek locations with abundant renewable energy resources. In this Viewpoint, we use Spain as an example. Spain is well positioned to receive and distribute data, which is why the number of data centers has increased significantly in the last few years, reaching a total of 74, with 28 centers under construction or planned. There are four reasons this region is becoming a digital hub and is expected to continue growing:

-

Submarine cable connections. Spain connects to the Americas through the largest submarine cables (Marea, Ellalink, and Grace Hopper), positioning it as a key destination for traffic interconnection. We expect this transatlantic route to grow significantly (reaching 691 terabytes per second from traffic by 2031), mainly driven by content provider growth and the deployment of new submarine cables. Mediterranean connections, including new cables like 2Africa, recently landed in Spain, and Medusa is expected to provide connectivity to Eastern Europe.

-

Highly developed fiber network. Spain has a highly developed dark and lit fiber infrastructure network covering its entire territory, facilitating connections from data centers to the transport network. In the past few years, this market has become increasingly dynamic thanks to competition from telcom provider Lyntia, the integration of several backhaul/backbone networks, the entrance of new investors (e.g., US firm KKR investing in Reintel), and the development of Spanish companies like Axent that are facilitating connections between data centers and top-tier hyperscalers. In 2023, public railway operator ADIF expressed interest in creating a fiber vehicle leveraging current and future high-speed rail track evolution (and the fiber that goes along the tracks), providing new routes for data-transport demand.

-

Increasing demand from hyperscalers. Spain is being targeted as a strategic cloud region by hyperscalers like AWS, Meta, and Google, all of which have announced investment plans in the region (see Figure 3). Hyperscalers perceive Iberia as the perfect hub to serve the Mediterranean and North African countries thanks to the factors mentioned above and the availability of reasonably priced land (more on this below).

-

Development of consumer communications and enterprise digitalization plans. Spain has a penetration of 73% of FTTH (fiber to the home) compared to 65% in the rest of Europe. 5G deployment will cover 75% of population in 2025, and 85% of enterprises have declared plans for digitalization.

ADDITIONAL KEY VARIABLES

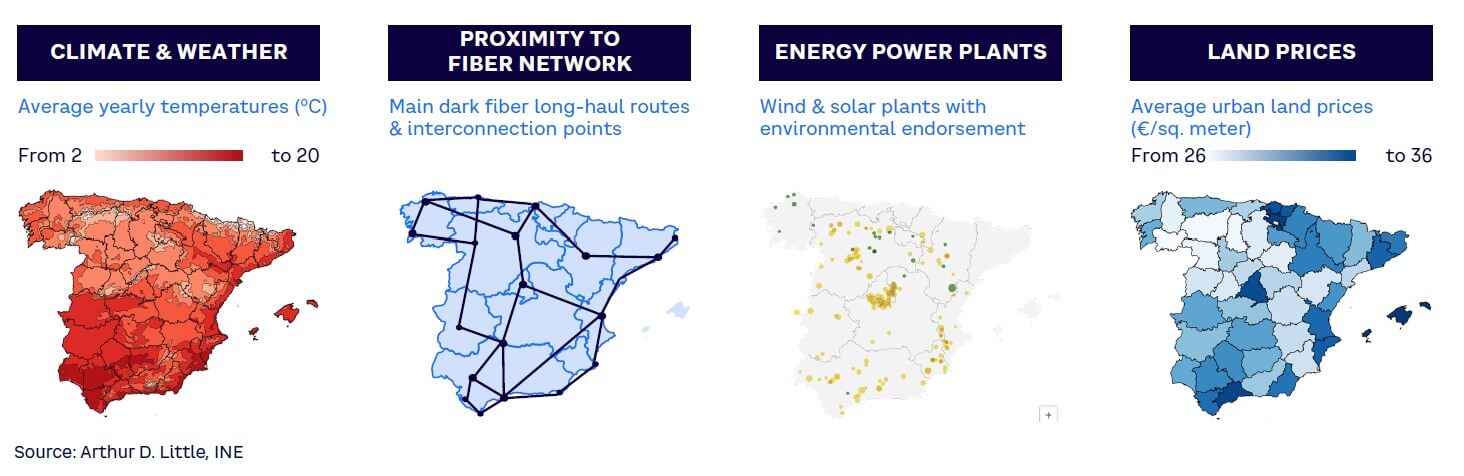

A data center’s integration opportunities depend on the location and environment in which it operates. These variables include:

-

Climate and weather. Climate conditions (e.g., average temperature) are important, affecting cooling needs and determining reliable green energy production levels (wind, sunlight).

-

Proximity to fiber networks. Data centers need to connect to a fiber-transport network, so proximity to infrastructure and subsea landing points is important.

-

Energy power plants. To enable green energy supply and allow renewable-asset hybridization (e.g., solar, wind) data centers must be close to a renewable energy plant and, if possible, integrated with one.

-

Land prices. Real estate is a key element of the data center business model: access to affordable land is critical to optimizing profit margins.

The country in our example, Spain, checks all these boxes (see Figure 4). This is particularly true for the Iberian region (“U Ibérica”), an area between the Basque Country, Catalonia, and Madrid where average temperatures are on the low end of the scale. Fiber availability is guaranteed, there are opportunities for energy power plant deployments, and real estate prices are low.

SINGLE & TWIN GREEN DATA CENTERS

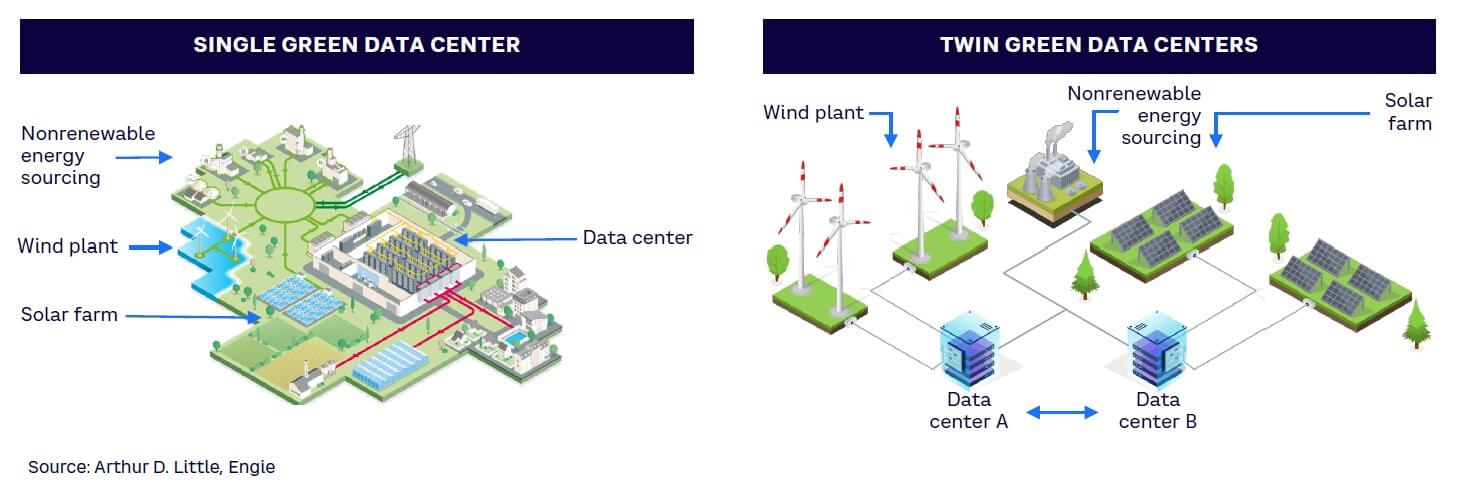

There are currently two related but separate ways to approach green data center creation (see Figure 5):

-

Single green data center. This approach involves a single campus with a data center, a solar field or wind farm (or both), a way to integrate the renewable power with the electrical grid, and a way to store excess power from renewables (to help lower peak-period costs). Renewable energy helps the data center lower the cost of peak-period energy while generating an energy surplus during off hours that can be channeled back to the grid.

-

Twin green data centers. Twin data centers have complementary energy-sourcing profiles, letting them balance each other’s needs through demand management. The centers are located in different areas and powered by renewable sources with different peak profiles (e.g., solar energy and wind power), so they can be integrated to flatten their power curves. For example, a data center in Spain’s southern region contributes solar power while a center in the northeast contributes wind power.

Conclusion

UNDERSTANDING SUSTAINABLE POWER-SUPPLY OPPORTUNTIES

Green data centers can play a key role in helping the EU reach its ambitious goal of achieving carbon neutrality by 2050. By making use of renewable sources like solar and wind-power energy, data centers can create an energy-supply profile that better fits customer demand. For example, green energy can be used during peak-demand periods when nonrenewable sources are more expensive, and surplus energy from renewable sources can be channeled back to the grid. However, such centers must be carefully located to succeed. Investors and other stakeholders should look for:

- Proximity to fiber networks

- Multiple green energy plants in the area, preferably ones that are amenable to integration

- Affordable land

- Favorable climates (excessive heat requires expensive cooling)

For example, Spain’s Iberian region checks all these boxes, with average temperatures on the low end of the scale, guaranteed fiber availability, opportunities for energy power plant deployments, and low real estate prices. Also, the possibility of exploiting decommissioned or nonrenewable power plants open doors for development in those areas, which typically fully comply with the aforementioned requirements.